Before applying for a Snyder auto title loan, thoroughly understand terms including loan amount, interest rates, and repayment schedule. Evaluate your financial standing to create a personalized plan, use online calculators for estimates, and ensure clear vehicle title documentation. For timely repayment, regularly monitor bank statements, consider independent inspections, and review the loan agreement to avoid defaults.

Repaying Snyder auto title loans on time is crucial to avoid penalties and maintain your vehicle. This comprehensive guide outlines clear steps to ensure safe repayment. First, understand the terms of your loan from Snyder Auto Title Loans, including interest rates and due dates. Next, create a tailored repayment plan that fits your budget. Additionally, learn strategies to protect yourself against default and delays, ensuring a smooth process. By following these steps, you’ll confidently navigate repaying your Snyder auto title loan promptly.

- Understand Your Snyder Auto Title Loan Terms

- Create a Repayment Plan That Works for You

- Protect Yourself Against Default and Delays

Understand Your Snyder Auto Title Loan Terms

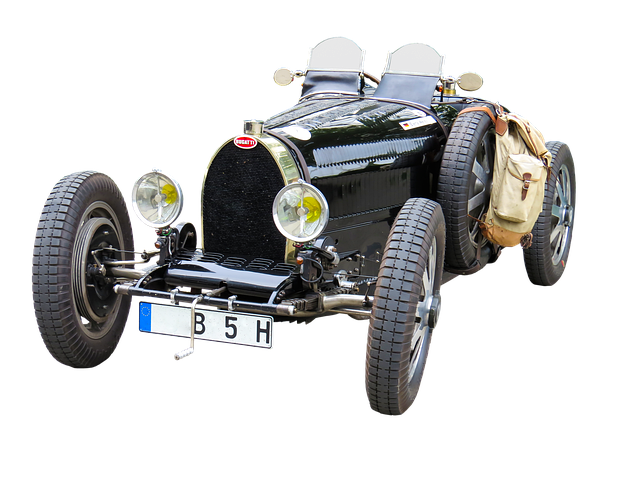

Before taking out a Snyder auto title loan, it’s crucial to understand the terms and conditions thoroughly. This includes grasping the loan amount, interest rates, and repayment schedule. Each Snyder auto title loan comes with specific terms tailored to the borrower’s needs, so reviewing these is essential. Knowing what’s expected during the repayment process helps in planning and ensuring timely payments.

One key aspect to focus on is the vehicle inspection process. Lenders may require a thorough inspection of your vehicle as part of securing the loan. This step ensures that the car or truck retains value and can be used as collateral effectively. Additionally, understanding flexible payment options available for Snyder auto title loans can make the repayment journey smoother. Many lenders offer adaptable plans to accommodate borrowers’ financial situations, allowing for more control over how and when payments are made.

Create a Repayment Plan That Works for You

When managing Snyder auto title loans, one of the best strategies to ensure timely repayment is to create a tailored repayment plan. Start by assessing your financial situation and determining the amount you can comfortably pay each month. Consider your regular expenses, savings goals, and other commitments to set realistic repayment goals. A structured plan allows you to break down the loan amount into manageable installments, making it less daunting and helping you stay on track.

The key is to find a balance between paying off the loan efficiently and maintaining financial stability. You can consult with the lender or use online calculators to estimate interest rates and understand how they impact your repayment. Additionally, reviewing your vehicle ownership details and ensuring clear title documentation will provide peace of mind during the repayment process.

Protect Yourself Against Default and Delays

When taking out a Snyder auto title loan, it’s essential to understand that timely repayment is key to avoiding potential defaults and delays. Protecting yourself against these issues starts with a thorough understanding of your obligations. Before agreeing to any terms, ensure you comprehend the repayment schedule and conditions clearly. A reputable lender will provide detailed information on when and how payments are due, as well as the consequences of missed or delayed payments.

Regularly reviewing your loan agreement and keeping an eye on your bank statements can help you stay on top of repayments. Additionally, consider getting a vehicle inspection done by an independent mechanic to confirm the assessed value of your car during the application process. This step ensures that the lender’s valuation aligns with the actual condition and market price of your vehicle, which is crucial in the event of a title pawn or if you need to sell it to repay the loan early.

Repaying Snyder auto title loans on time is crucial for maintaining your financial stability. By understanding your loan terms, creating a manageable repayment plan, and adopting proactive measures to avoid default or delays, you can confidently navigate this process. Remember, timely repayment not only saves you from potential penalties but also fosters a positive credit history, opening doors to future financial opportunities.